Did You Experience the Platform Economy Today?

Platform-enabled marketplaces, and other Internet-based goods and products with digital components and network effects are transforming the very idea of what a business is, how it creates value, and how it should be managed.

Platform-enabled marketplaces, and other Internet-based goods and products with digital components and network effects are transforming the very idea of what a business is, how it creates value, and how it should be managed.

This qualitative shift is combined with a quantitative one, as newer firms with a foundation built on modern information technologies accomplish activities at an incredible scale, speed and simplicity, in contrast to their incumbent competitors. No wonder that platform businesses have stormed at the head of economic activity.

Platform-mediated networks produce over half the revenue for over half of the world’s 100 largest companies. In the space of just 10 years, platform businesses have gone from occupying zero to occupying all top five spots for the five largest firms in terms of market capitalization, displacing traditional companies from their top positions held for multiple decades.

I had the opportunity to speak about platforms at the UC Davis Institute for Transportation Studies (ITS) recently. Here are some excerpts from that conversation.

What Are Platforms?

Platform businesses have a few distinctive characteristics. These characteristics are not necessarily found only in platforms (just like having hair is a characteristic of mammals, even though some non-mammals have hair) but they are vital to the idea of platforms.

First, platforms are characterized by network effects, which can be “direct” (also called “same-sided”) or “indirect” (or, “cross-sided”), and could be positive or negative. With direct (and positive) network effects, the idea is that a platform’s user finds more value in the platform when the platform has more users.

The smartphone map and traffic app Waze is an example. A Waze user finds Waze more valuable when there are more Waze users who join and engage by providing updates about traffic police, traffic speed, potholes, accidents, road construction etc. Direct network effects can also be negative by causing congestion, as in wireless networks.

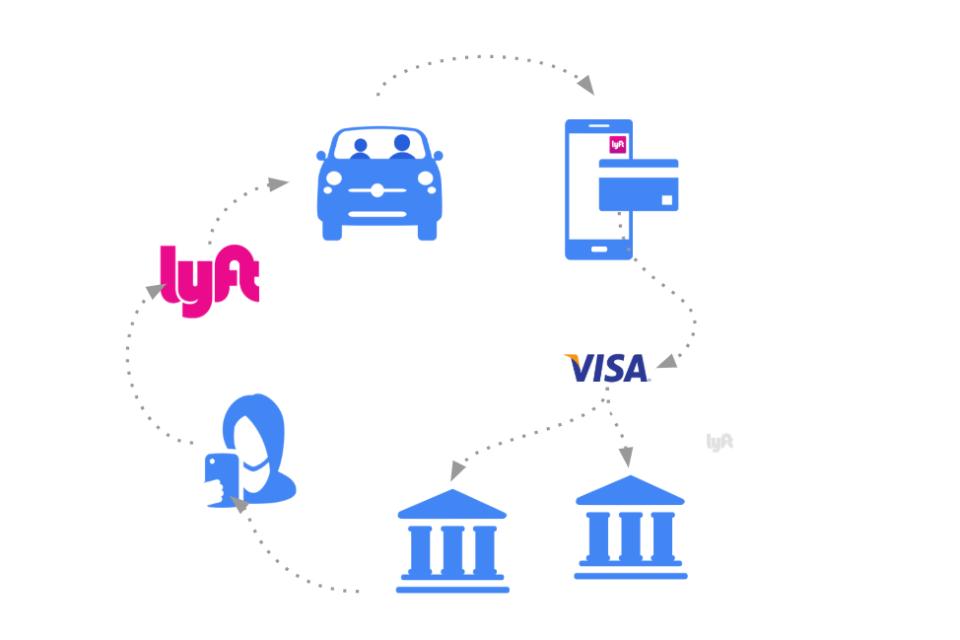

Platforms that have multiple types of user groups (e.g., a ride-hailing platform such as Lyft or Uber has a network of drivers and a network of riders) can also have cross-sided network effects, and these cross-network effects create a virtuous cycle or positive feedback loop, in which more drivers attract more riders (because rides are arranged more quickly) and more riders attract more drivers. In some platforms, cross-network effects can be negative in one direction (e.g., in content platforms, advertisers prefer more readers, but readers often want less advertising) and have to be managed differently than positive-positive cross-network effects.

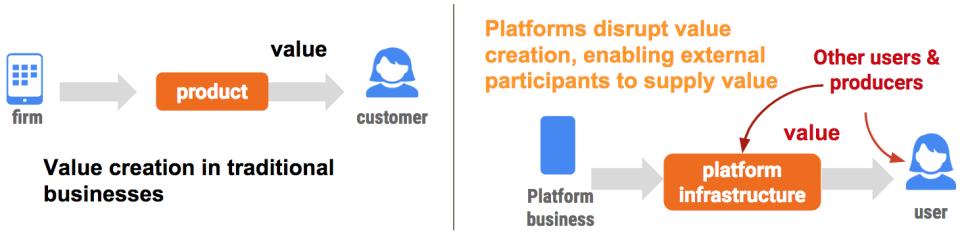

A second vital characteristic of platforms is that a substantial chunk of the platform’s value—the reason why it attracts participants—is provided not by the platform business itself but by external participants. People value Waze because of real-time traffic information, but that information is provided by Waze members rather than by Waze itself. People come to YouTube because of entertaining videos, but none of these are created by YouTube. This characteristic places platforms in sharp contrast to traditional businesses: the purpose of platforms is to enable value creation and exchange, whereas a traditional business is the one to supply value for its customers. A seed company supplies seeds. A traditional taxi fleet supplies the taxi and driver (fulfilling the rider’s need to go from A to B) whereas a Lyft enables someone else to supply your need (through location discovery, matching, coordination, payment support, dispute resolution etc.).

What platforms such as Lyft and YouTube do, instead, is to focus on providing infrastructure (both technological and non-technological) that enables the interactions between external participants and on setting the rules under which these interactions occur.

A third vital characteristic of platforms is willingness to cede control, or equivalently an openness to external players. In particular, platforms have an ability to bring in large numbers of low-volume partners who have low opportunity costs.

Before ride-hailing companies such as Uber, it was extremely hard for someone to be an independent small-scale supplier of transport. Someone wiling to spend a couple of hours a day ferrying passengers for a fee would be burdened by the overhead costs of marketing, advertising, legal requirements, demand generation, billing, etc. The same challenges applied to individual software developers, music artists, those with an occasional spare room, unique handicrafts etc. Sure, small-scale markets for such things existed, but they were generally marginal and heavily fragmented. Platforms aggregate large numbers of small suppliers to achieve the volume effect of traditional large businesses.

The enterprise software provider Atlassian started as a traditional product firm, with a cadre of internal software developers that built and improved and supported its software products such as Jira and Confluence. Founded in 2002, Atlassian realized in a few years the value of an open architecture and external software developers who could create value for Atlassian customers through software customization, and perhaps even offer their own innovations to other customers through Atlassian’s software app marketplace. Industry leaders such as Autodesk and Intuit have implemented similar transformations.

Twitter’s rapid success relies on an open API architecture (application programming interface, officially, but in essence a window into a firm’s data and software, which then enables software interconnections between a network of firms) that created a robust ecosystem of external developers who could make magic with all the data that flowed on Twitter. Whereas traditional businesses are so protective of their assets and customers, platforms thrive by being open and attracting external participants into their homes and markets.

What Makes Platforms So Powerful?

The disruptive power of platforms is evident in their successes and accomplishments, in how quickly platform firms have acquired industry leadership and created wealth. In what ways have the platform characteristics discussed above enabled them to do so?

Power of Network effects

Platforms are built around the positive network externalities that arise from interactions that take place on them. As the network grows, it increases opportunities for interaction, and hence value creation increases. In platforms, network effects—rather than the core product---account for a substantial chunk of value derived by participants.

A payment system like PayPal is more useful if more of your friends, family, and business partners have adopted it. This is in contrast to traditional non-network goods, such as say your dress shoes or your desk lamp or the fan in your room, where the product itself is responsible for nearly all the value you get from it, and it matters little to you who else uses the same shoes, lamp or fan. Network effects have a powerful effect. Once a platform grows a sufficiently large network, it is the network which then provides value and sustains growth and power.

Power of openness and ecosystems

Platforms are ecosystem companies that rely on a collection of external players to produce and/or innovate. A platform’s success depends on the ecosystem of external partners that it attracts and the speed and scale at which it can dynamically deploy parts of the ecosystem in service of each other, unlike a traditional business that is built on assets and long-term relationships.

Marriott, the largest hotel chain in the world, which started in 1957, took 60 years and hundreds of billions of dollars in investments to achieve a capacity of 1.2 million hotel rooms. Airbnb, which started in 2007, crossed 4 million rooms with a fraction of that investment because AirBnB itself supplies none of those rooms.

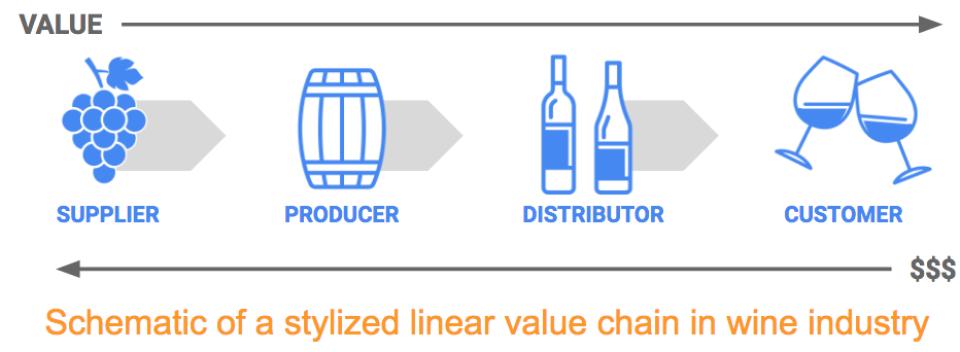

Platform businesses realize the need to permit external players to access (and even contribute to) vital pieces of the value-creating infrastructure, and consequently perhaps to share some of its profits with these external players. In doing so, platforms also establish themselves as the centerpiece of the power games that occur between market participants. Typically, very few businesses can manage all the pieces of value creation (production or acquisition of raw materials, processing, product development, distribution, customer management, etc.) and most businesses rely on coordinating with multiple business partners organized in a linear value chain. Value flows from left to right, currency in the opposite direction, and nodes in the value chain typically only deal with adjacent nodes.

Platforms disrupt this linear value chain and, in the process, destroy or cripple the market power of incumbent firms.

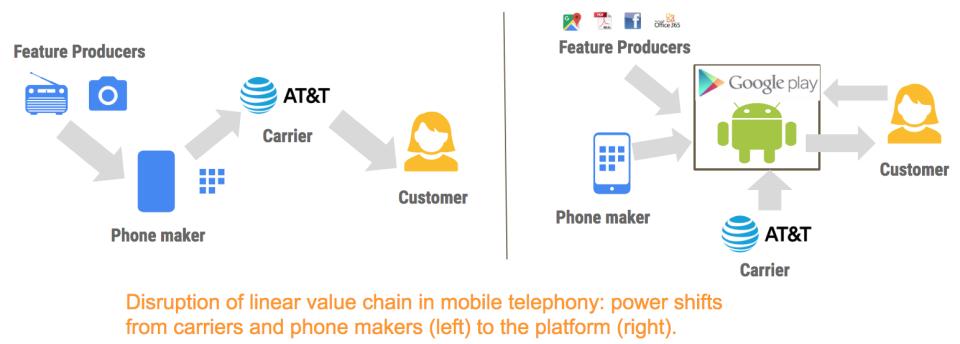

The mobile telephony industry provides a great illustration. It was organized along traditional linear lines until 2007: wireless carriers (service providers) offered service and phones to customers, and negotiated phone design with phone makers, controlling what features could be added on phones, and customers had no relationship with features makers or innovators. The smartphone changed all that, driven by a platform architecture.

The platform firm provided an operating system and a marketplace that allowed external innovators to extend the purpose and value of the phone. In doing so, it decimated the power of carriers and even phone makers to decide what features existed on the phone and what purposes it could be used for.

With platform design, power shifted from phone makers and service providers to the platform operator (Apple for iOS and Google for Android). This open architecture and potential for profits attracted thousands of external app developers who supplied hundreds of thousands of apps into the marketplace.

Previous incumbent leaders such as Blackberry, Palm and Nokia, who tried to regain market power by developing what they felt were awesome operating systems and phones, became locked out of this market because they lacked a vibrant ecosystem of app developers.

Power of data, analytics, and information technologies

Data, analytics, and information technologies have contributed in a profound way to the emergence of platform businesses. Nearly all the traditional businesses and organizations we have interacted with in our lives—furniture, hotels, music companies, construction, oil, banking, mining, education, textiles, retail, etc.—have a design and architecture that derives from the technologies of the first two industrial revolutions. These technologies and consequent innovations—steam engine, heavy machinery, electricity, telephone, high-speed rail transportation, machine tools, steam-powered factories, mechanical automation—transformed business into an activity that relied on and benefited from large scale, which required massive upfront investments but led to lower unit costs.

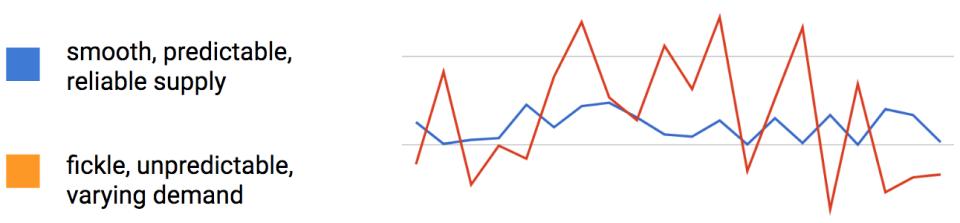

Production could be aggregated and centralized and done in massive quantities, because raw materials and finished products could easily be transported as needed, and because machines could be relied on to do repetitive work at large scale. Other aspects of business design followed, including how to manage labor, production, inventories, logistics, finance, accounts, marketing, etc. However, while this architecture enabled a steady and stable supply, these businesses existed in a world where demand was far more fickle and volatile.

The mismatch between demand and supply implies lost value, through excessive production in some cases, shortages in others, incorrect size or color, wasted advertising dollars, excess finished goods in one region with shortfall in another, and so on. These problems led to additional business innovations, including better forecasting, just in time production, lean manufacturing, make to order, mass customization, etc.: important, yet a bit like band-aids on a creaking and crumbling wall.

Data and the costs of managing it (acquiring, storing, cleaning, moving, analyzing, etc.) have always been an important determinant business decisions and design: what to do, how much to do, where to do it, in partnership with whom etc. In the past 50 years, these costs and capabilities have improved million-fold, and incredible new innovations such as the Internet and smartphones have emerged. The same old business architecture can simply not be optimal today.

Enter today’s platform businesses, which made their design decisions (e.g., what to do on their own vs. what to obtain from an external ecosystem) in response to the information technologies of today, rather than those of 20, 40 or 60 years ago. Among the biggest and most well-known platforms, all owe their existence and success to digital computers and/or the Internet, and several to the rise of additional innovations such as mobile phones (Uber would not be possible without GPS and mobility), reputation and rating systems (eBay and Airbnb couldn’t exist without them), open APIs and ecosystems (Twitter), and big data management and analysis techniques (Google, Facebook and many others).

Because platforms enable and coordinate (rather than invest and produce), bring in low-volume suppliers who have low opportunity costs, use real-time data analytics to match demand and supply or to set prices, they are far better positioned to meet high fluctuations in demand than traditional businesses.

Uber can bring on new drivers to the road within minutes, vs. the months or years it took in the taxi industry.

Airbnb can add hundreds of thousands of rooms in a fraction of the time it would take a hotel to set up an investment plan, obtain permits, arrange for construction, all while hoping that the demand doesn’t vanish by the time supply is built up. If demand does drop, supply can be winded down relatively easily as well because the platform consists of independent low-volume suppliers who have low opportunity costs.

By harnessing the power of network effects, a vibrant ecosystem of external partners, and data analytics and modern information technologies, platform businesses have a devastating and disruptive effect in most industries that they touch, as well as a transformative effect on society in general. Google and then Facebook changed our lives but also upended advertising, and consequently transformed the media and entertainment industries that were so dependent on advertising dollars. Lyft and Uber have hurt the taxi business but also transformed social patterns.

Smartphones, which transformed the mobile phone from a product to a platform by making an operating system and app store that connected an ecosystem of app developers to millions of consumers, wiped out the market power of mobile phone giants such as Blackberry and Nokia, and of telecom carries, within years. Similar disruptions have occurred in many other industries, and the platform revolution has only just begun.

This article only scratches the surface about the theory of platforms.

Professor Hemant Bhargava is a co-founder and program chair of the Master of Science in Business Analytics program and holds the Jerome and Elsie Suran Chair in Technology Management.

The author thanks Sundar Srinivasan (UC Davis) for capturing notes from the ITS talk, and to Alicia Looney (Google) for graphics support.

At the UC Davis Graduate School of Management, you can learn more, to understand how platforms are built, how they should be managed, how market outcomes can be analyzed and predicted, and how traditional companies should incorporate platform thinking into their business operations and strategy.